Financial modeling is the process of creating a summary of a organization’s or company’s expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event or decision.

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment

The process of combining historical and projected financial information to make business decisions

Financial modeling is one of the most highly valued, but thinly understood, skills in financial analysis. The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results.

What is a Financial Model?

A financial model is represented as spreadsheet which is usually built in Microsoft Excel, that forecasts a business’s financial performance into the future. The forecast is typically based on the company’s historical performance and assumptions about the future, and requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules (known as a 3-statement model).

From there, more advanced types of models can be built such as discounted cash flow analysis (DCF model), leveraged buyout (LBO), mergers and acquisitions (M&A), and sensitivity analysis. Below is an example of financial modeling in Excel.

- Financial modeling combines accounting, finance, and business metrics to create a forecast of a company’s future results.

- The main goal of financial modeling is to accurately project a company’s future financial performance.

- Modeling can be useful for valuing companies, determining whether a company should raise capital or grow the business organically or through acquisitions.

What is a financial model used for?

There are many types of financial models with a wide range of uses. The output of a financial model is used for decision-making and performing financial analysis, whether inside or outside of the company. Financial models are used to make decisions about:

- Raising capital (debt and/or equity)

- Making acquisitions (businesses and/or assets)

- Growing the business organically (e.g., opening new stores, entering new markets, etc.)

- Selling or divesting assets and business units

- Budgeting and forecasting (planning for the years ahead)

- Capital allocation (priority of which projects to invest in)

- Valuing a business

- Financial statement analysis/ratio analysis

- Management accounting

Who builds the Financial Models?

- Investment Bankers

- Equity Research Analysts

- Credit Analysts

- Risk Analysts

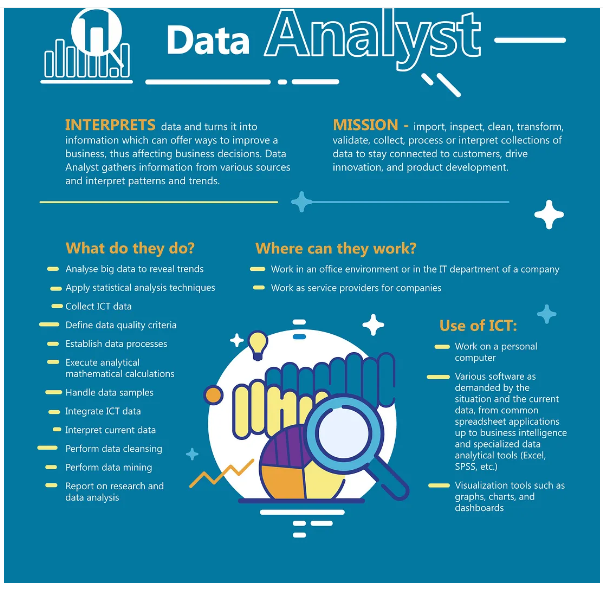

- Data Analysts

- Portfolio Managers

- Investors

- Management/Entrepreneurs

Financial modeling is a representation in numbers of a company’s operations in the past, present, and the forecasted future. Such models are intended to be used as decision-making tools. Company executives might use them to estimate the costs and project the profits of a proposed new project.

What are the Financial Modeling Tools used

- Microsoft Excel

- Excel Knowledge with good command

- Knowledge of Finance. & Accounts

- Knowledge of Accounting.

- Knowledge about Economy and Economics

- Mindset of Reality

- Presentation Skills & Learning Skills

- Visualization Skills

- Confidence