Description: Unlock a thriving career in the fintech industry with this detailed guide. Learn about job levels, required qualifications, certifications, salary trends, and how freshers can become fintech experts in 2025.

Step-by-step guide to becoming a Fintech Specialist in 2025. Covers education, job levels, certifications, salaries, and demand across India and globally.

🌐 Introduction: Why Choose a Career in Fintech?

Fintech, short for Financial Technology, has rapidly evolved into one of the most lucrative and impactful industries in the world. With the rise of digital payments, blockchain, AI in finance, and embedded banking, fintech jobs are not only in demand but highly rewarding.

In 2025, fintech is projected to contribute over $1.5 trillion to the global economy. From startups to legacy banks, the hunt for skilled fintech professionals is intensifying.

🔧 Career Levels in Fintech

| Level | Role Titles | Experience | Average Salary (India) | Average Salary (Global) |

|---|---|---|---|---|

| Entry-Level | Fintech Analyst, Product Associate | 0-2 years | ₹5-8 LPA | $50K – $70K |

| Mid-Level | Product Manager, Data Scientist | 2-6 years | ₹12-25 LPA | $90K – $130K |

| Senior-Level | Fintech Strategist, VP of Product | 7+ years | ₹30-60 LPA | $150K – $300K+ |

🎓 Education & Background

To become a fintech expert:

Recommended Degrees:

- B.Tech / B.Sc in Computer Science / IT / Electronics

- MBA/ PGDM in Finance / FinTech

- B.Com / BBA/ M.Com with specialization in Banking

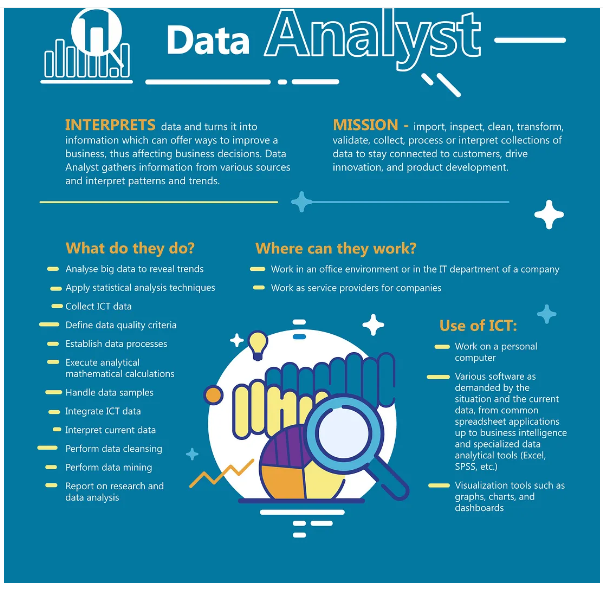

Desirable Skills:

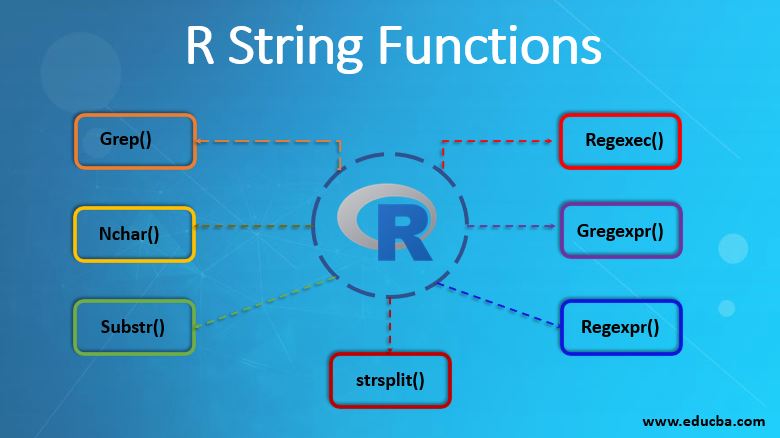

- Programming: Python, SQL, JavaScript

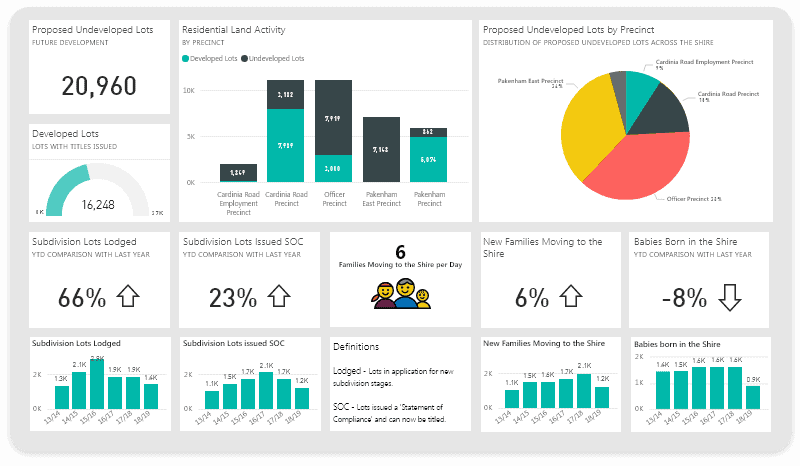

- Analytics Tools: Power BI, Tableau, Excel Advanced

- Blockchain & Web3

- APIs and Payment Gateways

- UX/UI Basics (for product roles)

🏋️ Certifications to Become a Fintech Specialist (2025)

Top Free/Paid Certifications:

- Certified FinTech Professional (CFtP) – Global Fintech Institute

- Fintech: Foundations & Applications – Wharton on Coursera

- Fintech Professional Certificate – Harvard (edX)

- AI in Finance – CFA Institute

- Blockchain Specialization – Coursera

📉 Salary Trends for Fintech Jobs in 2025

- India:

- Entry: ₹5-8 LPA

- Mid: ₹12-25 LPA

- Senior: ₹30-60+ LPA

- Abroad (USA, UK, Singapore, Australia, Etc.,):

- Entry: $60K+

- Mid: $100K+

- Senior: $200K – $400K+

Top Companies Hiring: Razorpay, Paytm, PineLabs, Stripe, Revolut, Visa, MasterCard, PhonePe

🔄 Path for Freshers to Enter Fintech

- Pick a Domain: Lending, Insurtech, Payment Gateways, Blockchain, Personal Finance

- Learn Relevant Tools: Python, Power BI, Excel, API handling

- Internships: Apply on AngelList, Internshala, or LinkedIn

- Certify Yourself: As listed above

- Projects: Build case studies or prototypes like a digital wallet, loan calculator

- LinkedIn Profile: Highlight tools, certifications, and internships

✨ Real-Time Industry Demand in India (2025)

- 2000+ fintech startups in India

- 40% growth in digital payment systems

- RBI pushing for innovation through regulatory sandbox

- Tier 1 cities leading job creation: Bengaluru, Mumbai, Gurgaon, Hyderabad

✅ Pros & Cons of Becoming a Fintech Expert

Pros:

- High-paying & globally in-demand

- Opportunity to innovate in finance

- Remote job flexibility

Cons:

- Fast-paced, requires upskilling

- Regulatory hurdles (esp. in crypto)

- Competitive job market

🚀 Future Scope of Fintech (2025-2030)

- AI-led underwriting

- Blockchain for Know-Your-Customer (KYC)

- Robo-Advisors replacing traditional investment agents

- Open Banking APIs globally adopted

- Neobanks rise in Tier 2/3 India cities

📆 Final Words: Why You Should Pursue Fintech Now

Fintech is not a passing trend—it’s the new financial system. Whether you’re from a tech or finance background, 2025 is the best time to invest in yourself and become a fintech professional.

⚠️ Disclaimer & Caution Notice

Disclaimer: The content provided by “TheFactsGenie” is for informational and educational purposes only. While we strive to ensure the accuracy and relevance of all data, including salary ranges, certifications, and job roles, the information is subject to change based on market dynamics and organizational policies in 2025 and beyond.

Caution:

-

Readers are advised to independently verify course content, pricing, and certification validity from the official websites before enrolling.

-

Career decisions should be taken after personal research, career counseling, and skill assessment.

-

This blog does not guarantee job placement, salary, or promotions after certification or upskilling.

-

Job market trends may vary by region, sector, and candidate profile.

“TheFactsGenie” is not affiliated with any universities, training providers, or fintech companies mentioned unless explicitly stated. All brand names, logos, and trademarks belong to their respective owners.

Every time I visit your website, I’m greeted with thought-provoking content and impeccable writing. You truly have a gift for articulating complex ideas in a clear and engaging manner.

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike

Your writing has a way of resonating with me on a deep level. I appreciate the honesty and authenticity you bring to every post. Thank you for sharing your journey with us.